When I first stepped into the world of real estate, I was hit by many questions. “How to invest in real estate?” “Where do I begin?” “What if I make a wrong move?” Sounds familiar? These are common hurdles aspiring real estate investors face, which may hold back action.

But here’s a solution: knowledge and the right strategies to take action. In this article, I will share nine actionable ways of real estate investing for beginners to get started. I ranked these strategies in order of difficulty, based on my experience and research, while providing supporting ideas.

Over the last ten years, I have invested in real estate with these ideas while working a primary job. My real estate investments now give me significant passive income, bolstering my financial freedom.

I encourage you to read through to the end to take action on your real estate investment plan for your full benefit. We will cover the following:

General Information Only

We are committed to providing accurate information to the best of our knowledge. The information provided in this article is intended for general informational purposes only. It is not a substitute for professional advice and should not be relied upon as such. See our terms of service here.

The Best Ways to Invest in Real Estate

To give you the best information on how to invest in real estate, I proceeded with not just creating a list of the ‘9 best strategies of real estate investing for beginners in 2023’ but also ranking them in order of increasing difficulty:

- Buy Real Estate Investment Trusts (REITs)

- Join Real Estate Investment Groups (REIGs)

- Buy and Hold Single-Family Rental Property

- Try Raw Land Investing and Flipping

- Start Wholesaling Real Estate

- Buy Multifamily Property With or Without Money

- Start an Airbnb Business with Vacation Rentals

- Get Into Commercial Real Estate Investing

- Start House Flipping or The BRRRR Method

The strategies are listed in order of increasing Overall Difficulty Score, which is an average of difficulty scores on Capital Intensity (initial capital and liquidity), Time Involvement (time commitment and learning curve), and Risk Exposure (returns volatility and loss potential).

1. Buy Real Estate Investment Trusts (REITs)

A Real Estate Investment Trust (REIT) is a company that owns and often manages income-producing properties in sectors like residential, commercial, and industrial. By buying REIT stock, individual investors can invest in large projects with a steady income and tax benefits.

To get started with REITs, open a brokerage account if you don’t already have one, research REITs that align with your investment goals, and buy shares either directly as stocks or indirectly in Mutual Funds or Exchange Trade Funds (ETFs) after understanding the risks.

You earn income from REITs through capital appreciation and steadily growing dividend income. With low initial capital requirements, this is how I began my journey in real estate investing, and I have ranked this with the lowest difficulty score on the list.

2. Join Real Estate Investment Groups (REIGs)

A Real Estate Investment Group (REIG) is an organization that focuses on acquiring and operating properties, often pooling the capital of multiple investors. Unlike REITs, which are publicly traded, REIGs are usually private entities that can deal in a broader range of real estate activities.

Joining a REIG is straightforward. Research groups in your area or real estate crowdfunding platforms online, like Fundrise and Crowdstreet, while attending meetings where applicable. If you decide to invest, join your desired group while understanding the minimum investment contribution.

You make money with REIGs mainly through rental income and property appreciation. The REIG manages the property and tenants, collects management fees, and distributes the net income to the investors. Your stake appreciates in line with the property, and you can cash out later.

3. Buy and Hold Single-Family Rental Property

Buy and hold single-family rental property is a long-term real estate investment strategy that involves purchasing a single-family home and renting it out for a stable income over an extended period, typically three or more years. You maintain the property while collecting rental income.

To start with single-family, research neighborhoods with high rental demand, decent schooling, and good property values; location is critical. Select and purchase a house that meets your budget and make it rent-ready. List it for rent to high-quality tenants for income, or try house hacking.

Money is mainly made from monthly rent after deducting maintenance and other expenses. In the longer run, the real property likely appreciates, adding to your wealth, while tax write-offs, like depreciation, can increase your return on investment (ROI). This has been my primary strategy.

4. Try Raw Land Investing and Flipping

Raw Land Investing involves buying undeveloped land, intending to develop or lease it, and possibly selling it later at a higher value. Land Flipping means buying land, making improvements or waiting for real estate market conditions to improve, and selling for a profit.

The first step is market research to identify potential growth or development areas. Once you find the right location, negotiate a deal, buy the land, and improve it (like getting it zoned for specific use) or hold until the market conditions are ripe for a profitable sale.

Profit from this strategy comes mainly from the difference between your buying and selling price, boosted by any improvements or beneficial zoning changes you make. This method requires patience, specific experience, and a strategic approach, while the returns can be significant.

5. Start Wholesaling Real Estate

Wholesaling real estate is a short-term investment strategy involving a wholesaler signing a contract to purchase a property and then selling that property to another buyer at a higher price before the deal closes. Unlike flipping, the wholesaler does not improve the property.

To start real estate wholesaling, research your market to find undervalued properties or motivated sellers. Get the property under contract and then find an investor or quick buyer to sell the contract to. Sounds simple, right? Mastering the art of finding deals and investors or cash buyers is vital.

In wholesaling, your profit comes from the ‘spread,’ which is the difference between the contracted price with the original seller and the price you sell the contract to the end buyer. The key is to buy low and quickly sell high, thus maximizing the spread.

6. Buy Multifamily Property With or Without Money

Investing in Multifamily Units involves buying residential real estate investment property that houses two or more dwelling units. You can use your capital or other financing strategies like real estate syndication, owner financing, or partnerships to invest with little to no upfront money.

Find a good deal by looking into suitable real estate markets and property types. Secure your financing options, ranging from conventional loans to partnering with investors. Before closing the deal, conduct due diligence, including detailed inspections and rent roll assessments.

Your profits come primarily from the rent and other fees. The rent typically covers mortgage payments, interest, maintenance, and capex expenditures. Value-add multifamily real estate investing is a great strategy to boost your return on investment.

7. Start an Airbnb Business with Vacation Rentals

Starting a vacation rental business using online real estate platforms like Airbnb involves acquiring or leasing properties to host guests on a short-term basis. Unlike traditional rental properties, they are often more flexible and are specifically designed to offer guests a memorable experience.

Begin with Airbnb monthly rentals by first identifying a good location with high tourist demand. Buy or lease a property while ensuring it meets all local regulations. Furnish and decorate the house to offer a unique experience. Then, list it on Airbnb and other similar platforms to start receiving bookings.

Cash flow is earned mainly from nightly rates charged to guests after deducting operating expenses. You can increase your profit margins by upselling additional services like guided tours, cleaning services, or breakfast options.

8. Get Into Commercial Real Estate Investing

Commercial real estate investing involves buying or developing properties meant for business use, which include office buildings, retail spaces, and industrial complexes. Unlike residential real estate investments, commercial is focused on income generated through business tenancy.

Research and identify your target market and building types to get started. Then, partner with a skilled property manager while networking with real estate developers and brokers to find potential deals. Decide your strategy (‘buy and hold’ or ‘develop and sell’), raise capital, and then buy or develop.

You make money with this strategy through rents from business tenants and property appreciation. You might negotiate favorable long-term lease terms (like Triple Net or NNN leases) that transfer certain expenses to tenants to boost your ROI.

9. Start House Flipping or The BRRRR Method

House flipping and the BRRRR method (Buy, Rehab, Rent, Refinance, Repeat) are investment strategies focused on short-term profits. While house flipping entails buying, renovating, and quickly selling for a profit, BRRRR turns the renovated property into a rental and extracts built equity.

First, identify a property with the potential for increased value, validate returns, secure funding, and then buy. Next, carry out necessary renovations, keeping a keen eye on costs. Finally, either list the property for sale (house flipping) or turn it into a rental property (BRRRR).

For flips, you make money by selling the home at a higher price than the purchase and renovation costs. For BRRRR, you’ll earn income from the rental property, then refinance to reclaim your initial investment, allowing you to repeat the process.

Why Invest In Real Estate? Top Benefits

The question of why invest in real estate often arises among seasoned and new investors. From my experience with direct real estate investments over the past decade, the advantages far outweigh the risks.

Cash Flow

The promise of passive cash flow drove my first investment in real estate. Rental properties, especially those in high-demand areas, can provide a consistent income to offset mortgage payments and operating expenses. This now buttresses my primary income.

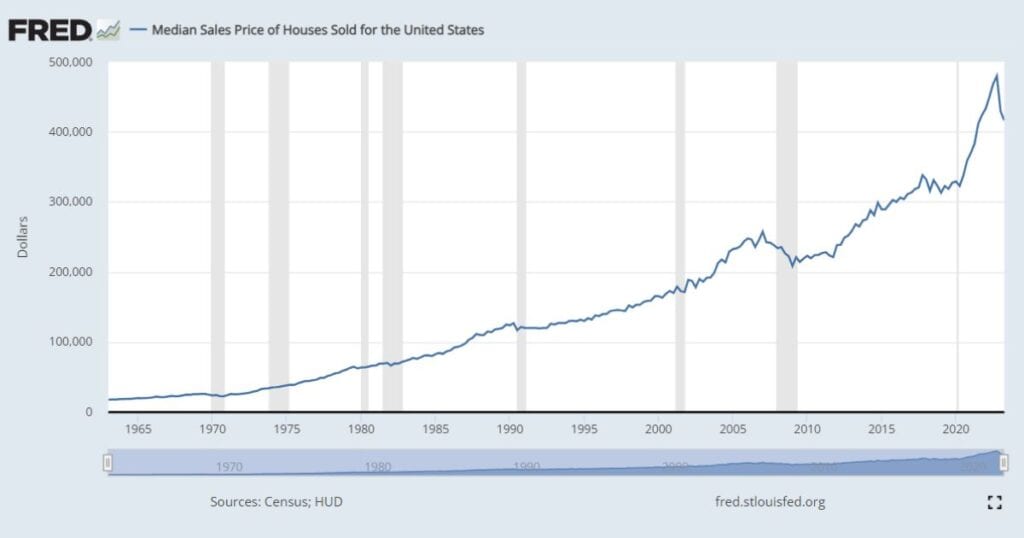

Asset Appreciation

Real estate has historically been an appreciating asset. Multiple properties I purchased years ago in good neighborhoods have increased in value and given me avenues to cash out refinance (tax-free) and tap into the equity to acquire more property.

Equity Building

I see paying down a mortgage as a ‘forced savings plan.’ Each payment increases your equity in the property, offering you a more extensive asset base for future leveraging or additional investments. Historically, real estate has been a top wealth-building vehicle.

Tax Benefits

The tax advantages associated with real estate investments can be significant. Depreciation write-offs, interest deductions on mortgage payments, and the potential for a 1031 exchange can significantly enhance profitability while reducing your tax burden.

Portfolio Diversification

Investing in real estate offers a tangible asset that provides diversification away from more volatile assets, as seen in the stock market. Owning a physical investment property can hedge against market fluctuations, reducing your overall investment risk.

Inflation Hedging

Inflation tends to erode the purchasing power of your money. On the other hand, real estate investments often increase in value at a rate that outpaces inflation as they are a kind of ‘package of commodities.’ As property values and rents rise, real property can be an effective inflation shield.

Leveraged Returns

Real estate allows for leverage, meaning you can make a smaller down payment and borrow the rest, amplifying your potential return on investment. When using leverage, one must apply the necessary risk management strategies to help manage your financing risks.

Asset Control

One of the most empowering aspects of real estate investments is your degree of control. From property selection to determining rent and lease agreements, you are the decision-maker, entirely in control and directly influencing your investment’s performance.

Beginner Challenges with Real Estate Investments

In the early stages of owning real estate rental property, multiple pitfalls initially challenged me to take action. This is typically common for most beginners and sometimes for experienced investors.

Here are some challenges with suggestions of solutions to help you take action.

Analysis Paralysis

You want to make the ‘perfect’ decision but are stuck with much information, endlessly weighing the pros and cons. Here’s a solution: Start small. You don’t have to invest a lot, but the key is to start. Use basic strategies initially; then, you can diversify your approach as you grow.

Lack of Knowledge

Many new investors feel they must be experts in stock markets or real estate investments before taking the first step. The truth is you learn by doing. Start by reading reliable sources, watching videos (I do this often), or even considering a mentor. The more you immerse yourself, the faster you’ll learn.

Fear of Loss

The fear of losing money can be paralyzing, but all investments come with some risk. Diversify your portfolio to spread risk while applying other real estate risk management strategies. Short-term market volatility is normal, but don’t let it deter you, as investing is a long-term journey.

Cash Flow Management

Managing cash flow can be tricky when investing in things like a residential rental property. It can feel overwhelming between maintenance costs, mortgage payments, and property taxes. Solution? Create a budget and stick to it. Account for all possible expenses and set aside an emergency fund.

The challenges and risks with real estate investing are real, but they can be managed. Understanding how to invest in real estate and managing its risks can help you overcome these challenges, helping you take action to build passive income.

FAQs: Real Estate Investing for Beginners

Conclusion

How to invest in real estate is a topic with many layers. Whether you are just starting or experienced, the best ways to invest in real estate can differ based on your goals and risk tolerance.

Real estate investing for beginners might seem daunting, so we ranked the nine investing strategies shared here in order of increasing difficulty to give you a further understanding of your options.

Here are some actionable takeaways:

- Educate Yourself: Knowledge is power in real estate. Understand market trends, laws, and investment strategies like the best ways shared in this article.

- Network: Build relationships with real estate agents, contractors, and other investors. You can also join groups like BiggerPockets or social media groups.

- Be Financially Prepared: Ensure you understand your investment’s financial demands, from down payment to maintenance costs.

- Diversify: Don’t put all your eggs in one basket. Consider a variety of investment options shared from REITs to actual rental properties.

- Consult Professionals: Before making major decisions, consult real estate professionals and financial advisors.

When approached thoughtfully, the long-term real estate journey could be challenging but financially and personally rewarding.

My final advice is to take action!

Join Our Community

Embark on your real estate journey with a supportive community by your side:

- Get our Passive Income Checklist, which is a free guide.

- Join our Newsletter to stay updated with our latest insights.

- Read our Blog to immerse yourself in rich real estate content.

- Connect with us on Facebook, Twitter, and Instagram to engage.